A guide to South African payment rails

Payment rails can be global or local in nature, and different options might be preferred for different businesses, depending on what their payments needs are and what they’re looking to achieve as a business. In this guide, we look at the existing payment rails in South Africa and how they work together.

The payments landscape in South Africa has evolved at a rapid pace over the last few years, with more payment methods - meaning more options - than ever before available for businesses to offer consumers. Demand continues to rise from consumers for more choice in how they wish to pay, and access to more seamless and secure payments experiences.

These payment methods are built on top of the payment rails available in the South African market, each of which offers different benefits and experiences.

What are payment rails?

Payment rails are the infrastructure that allows money to move from one party to another. They encompass the technology, systems, rules, processes and networks that facilitate financial transactions. In essence, payment rails are the conduit that allows money to flow between different organisations and individuals.

There are a number of different payment rails in operation globally, from traditional card networks such as Visa and Mastercard, to automated clearing houses used by banks, to the newer wave of open banking-enabled instant payment networks such as India’s Unified Payments Interface (UPI) and the UK’s Faster Payments Network.

Payment rails can be global or local in nature, and different options might be preferred for different businesses, depending on what their payments needs are and what they’re looking to achieve with different types of transactions.

Payment rails in South Africa

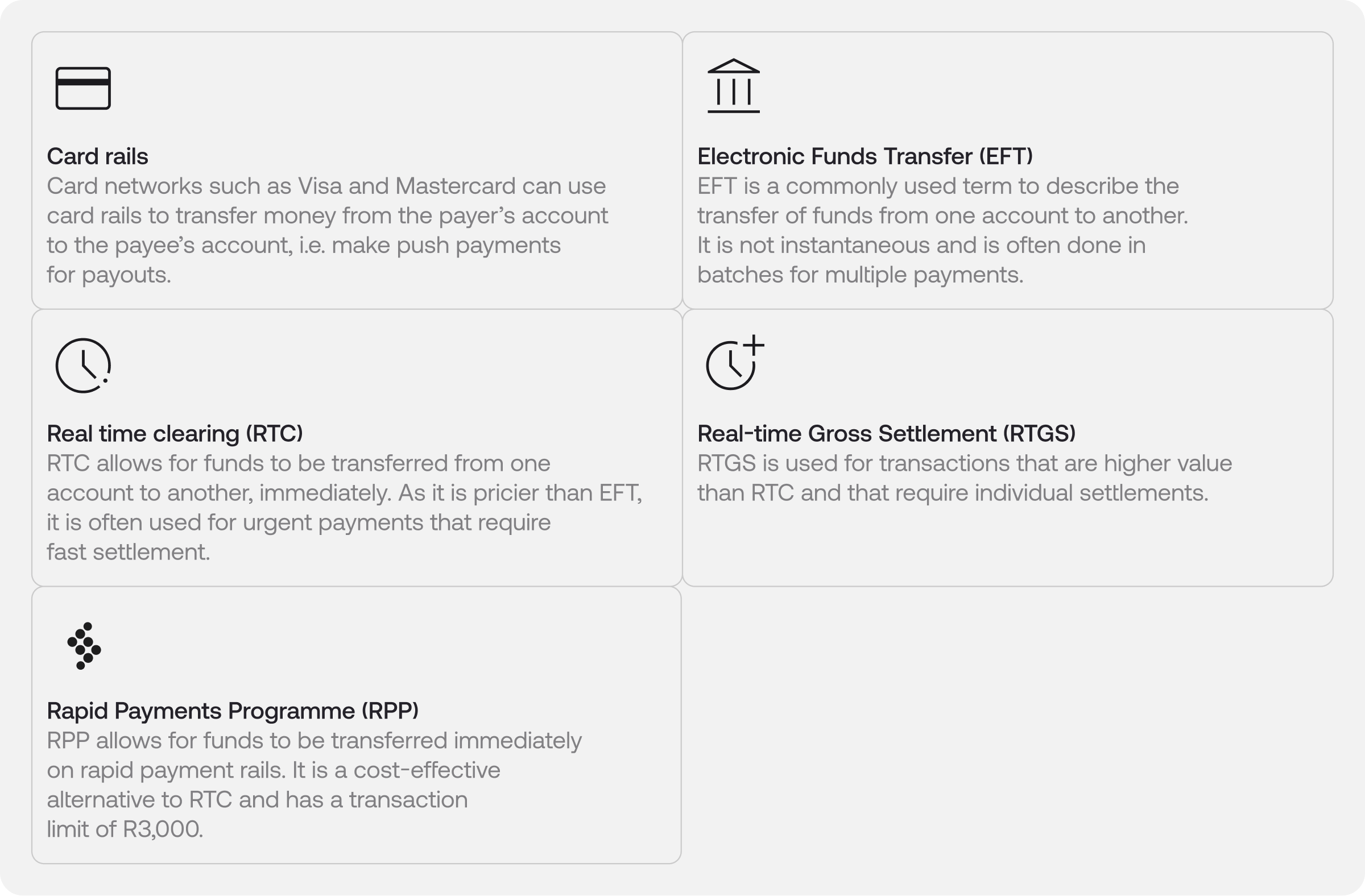

Below is a list of the main payment rails in use across South Africa, including how they work and how they can meet different needs for enterprise businesses.

Card rails

Card networks are perhaps the most popular of all digital payment rails globally. Visa and Mastercard are the two most popular providers, each with more than a billion cards in circulation.

Card payments have been around for a long time, and many additional or alternative payment methods position themselves as a way to replace card payments, offering faster settlement times, lower fees for merchants and more. However, card rails are still growing in popularity as consumers reduce their reliance on cash and increasingly spend money online - and new, more convenient solutions such as smartphone wallet payments are built on top of card rails.

Here’s an overview of how the card payment process works for online transactions:

- A customer initiates a card payment via an online store or service. The merchant’s payment gateway views their card details and communicates with the retailer’s bank (the acquiring bank)

- The acquirer then contacts the issuer to provide approval for the transaction. The issuer will validate the transaction, checking whether the account is valid, whether there are sufficient funds, etc.

- An approval message is sent to the acquirer. The issuer places a hold on the customer’s funds

- Later, often at the end of the business day, all approved payments are transferred in batch to the merchant account. This is known as settlement, and it is at this point that the card network, the issuer and the acquirer charge transaction fees

Card payments generally take between one and four days to clear.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer (EFT) is a term used to describe the transfer of funds from one bank account to another in South Africa. EFT payments can come in many forms, from electronic checks and phone payments to direct deposits. EFTs are not instantaneous and are often settled in batches. As a result they tend to be more cost effective than payments made via other, more instant, rails and card payments.

Manual EFTs differ from Pay by bank transactions in that Manual EFTs require customers to leave the app or website they’re looking to pay and open their banking app or portal to initiate a transfer using the bank account details and reference provided. Pay by bank enables faster, more seamless, transaction initiation that allows customers to enter their banking details without leaving the app or site they’re looking to pay.

With Stitch Pay by bank, returning customers can pay more seamlessly, without leaving the app or site they're on, and can save their bank details to pay in one click whenever they come back to make another payment. The result is a much smoother, faster and more efficient payment experience. Pay by bank transactions also settle faster - in 1-2 days - while Manual EFTs can take 2-3 days.

Here’s an overview of how EFT payments work:

- Initiation

The customer initiates the transfer. This can happen in a number of ways, for example through their online banking app or portal, via bill payment services or by providing payment details over the phone. The payer provides details of the recipient’s bank details such as their account number and a unique reference - Verification

The payer’s bank verifies the transaction details, including the availability of funds and, often, the identity of the recipient. With Stitch, the payer’s identity can also be verified against KYC details stored by the merchant - Transfer

Once the transaction has been verified, the payer’s bank debits their account - Confirmation

The payer and recipient both receive confirmation of the transaction. This often happens through the banking app, via email or by SMS - Settlement

The EFT network clears and settles the funds. This may happen through bulk processing or individually

Once an EFT payment clears, it is final and irrevocable.

Real-Time Clearing

Real-Time Clearing (RTC) is a form of instant payment that allows funds to be transferred from one account to another, immediately, and irrevocably. RTC payments are more expensive than EFTs, and are used more regularly for payments that require fast settlement. They are used for lower value transactions (R5 million and below). According to the Payments Association of South Africa (PASA), South Africa pioneered the first interbank RTC payment.

How it works:

- Initiation

The payer issues a payment instruction to the paying bank. This can be done over the phone, online or in a bank branch - Settlement

The paying bank then credits the beneficiary account within 60 seconds

Real-Time Gross Settlement

Real-Time Gross Settlements (RTGS) are used for transactions that are higher value than those sent via RTC (i.e. higher value transactions above R5 million), and that require individual settlements.

As the name implies, settlements within an RTGS system happen as soon as transaction information is received from the sending bank, making them irrevocable. Due to their real-time nature, these payments are not batched.

RTGS is typically used for high-value (over R5 million) interbank transfers of funds, and RTGS systems are often operated by a country’s central bank. In South Africa, the RTGS system is operated by the South African Reserve Bank (SARB).

In June 2021, the SARB launched the RTGS Renewal Programme to improve payment provision for the domestic and regional financial system, enhancing access to payment services.

Rapid Payments Programme (RPP)

The Rapid Payments Programme (RPP) - also known as PayShap - was initiated by Bankserv Africa, in line with the South Africa Reserve Bank’s Vision 2025. RPP allows funds to be transferred from one bank account to another, immediately, on instant rails. Today, it is available for lower value transactions - currently under R3000 - and primarily for P2P transactions. It's more cost effective than RTC.

RPP payments are instant, irrevocable, easily accessible and interoperable. There are currently 11 South African banks participating in RPP: ABSA, African Bank, Bankserv Africa, Capitec, Discovery Bank, FNB, Investec, Nedbank, Sasfin, Standard Bank and TymeBank.

RPP comprises three core services:

- Instant payments

This is a real-time clearing service that enables reconciliation of cleared transactions between participants and facilitates settlement obligations in the SARB settlement system, as well as handling all required reporting - Proxy payments

This allows users to make a payment without the need to enter an account number; they can instead use their associated mobile number as a proxy - Request to pay

This service has yet to be released, but once live will allow payees to request funds from other parties across any participating bank

Other popular payment methods that don’t leverage the above rails

Crypto

Cryptocurrencies use decentralised ledger blockchain technology to track transactions and prevent fraud. Crypto is popular in South Africa, with many South Africans showing a willingness to transact using popular cryptocurrencies such as Bitcoin or Ethereum.

Cryptocurrencies can be volatile, with large swings in their value relative to traditional, “fiat”, currencies. Stitch offers Pay with crypto functionality to its clients, enabling them to accept payments in crypto and get settled in fiat currency, without the need to manage the crypto transactions themselves. Stitch and our partner manage volatility risk so our merchants don’t have to.

Here’s an overview of how crypto payments work:

- Before transacting, crypto users must typically set up a digital wallet to hold their funds. This is comprised of a public key - used as an address to receive payments - and a private key, which is used to authorise transactions

- To initiate a transaction, users enter the recipient’s public key and the transaction amount. Their private key then verifies the transaction

- Once verified, the transaction is broadcast to the blockchain network, where it is validated by the computers running the blockchain (known as “nodes”). The record of this transaction is then added to the blockchain network’s public ledger to prevent tampering

- The transaction is then settled directly between users, without the need for intermediaries

Vouchers

Vouchers are a cash-to-digital payment option used by many South Africans, enabling those without a bank account to transact digitally or add funds to a digital account. Vouchers can be used online as well as in physical retail locations.

How it works:

- Customers exchange cash for vouchers in a physical retail location, such as a supermarket or petrol station

- Customers can then enter their voucher number on an app or site to top up their digital wallet

- Once topped up, users can transact, bet or trade using the funds in their digital wallet

Cash at ATM

Similar to vouchers, Cash at ATM allows customers to exchange their cash to pay for digital goods or top up a digital account. With Stitch Cash, users deposit cash at an ATM or bank branch rather than paying through a digital payment gateway. It can be used as a way to pay for online purchases, to top up digital accounts or make other payments such as debt payments, using physical currency.

Here’s how it works:

- Customers choose “Cash at ATM” or “Cash at till” when checking out online

- They receive a unique payment reference - which can be entered when completing the payment at an ATM or bank branch

- As soon as the payment is confirmed, the amount is attributed to the customer’s digital account. They receive a notification that the transaction has been completed

As new rails and payment innovations emerge, Stitch remains at the forefront thanks to our direct integrations and connections across rails and banks.

Looking for a reliable payouts solution, built for enterprise businesses at scale?