Enterprise payments. Engineered for performance.

South Africa’s most reliable payment gateway. An end-to-end payments platform designed to optimise payments performance and streamline financial operations. We help enterprise businesses increase revenue and keep customers coming back.

One platform to collect, streamline and manage payments

Increase payment success rates, reduce costs and streamline financial operations through a single platform. Use Stitch for online payments, in-person payments, recurring collections and financial management – with seamless reconciliation and reporting, built-in redundancies for payments optimisation and automated fraud prevention.

Accept online payments

Offer any available payment methods in South Africa, with flexible integration options

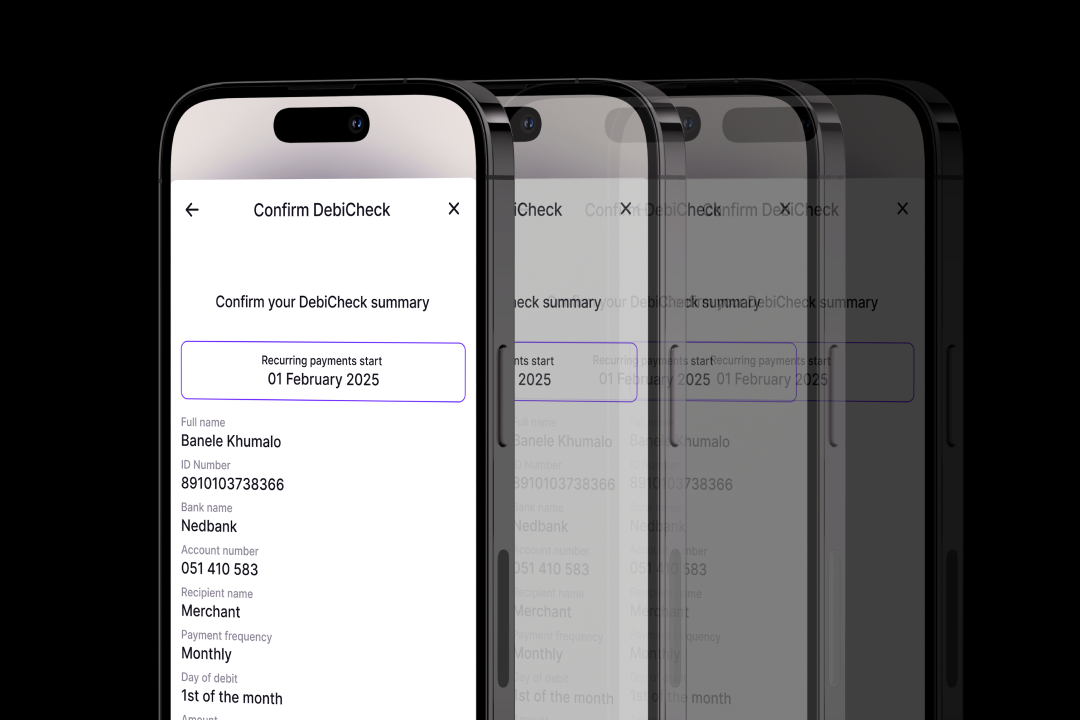

Boost recurring collections

Offer multiple recurring methods and enable automated fallbacks to never miss a payment

Send payouts, 24/7, 365

Initiate instant and reliable refunds, withdrawals and disbursements – anytime, any day

Optimise in-person payments

Accept reliable in-person payments at POS, including card present and alternative methods

Unify payments online and in person

Stitch offers a true unified commerce solution. Manage online and in-person payments through a single partner, with a centralised dashboard, streamlined reporting and a seamless and personalised customer journey – no matter where your customers choose to shop.

Elevate your e-com payments with Stitch Express

Running an e-commerce business on Shopify, Woo, Squarespace or Webflow? Built on enterprise-grade payments technology and curated for a world-class checkout experience, Stitch Express is designed to increase conversion and boost your revenue.

Designed for enterprise

Built for scale

From custom integrations and deep, hands-on technical support, to dedicated client success representatives, 24/7 support and firstline communications in the event of any issues, Stitch is on your team.

Our solutions are built for enterprise businesses with complex payment needs.

Our client-first ethos means we see ourselves as an extension of client teams, from integration to optimisation and beyond

Our dedicated support team is always on, and will communicate quickly in the event of any issues or downtime

Increase conversion rates with one-click payments, and automatic routing to alternative methods in the event of failure

You choose the level of customisation in your Stitch integration. Integrate our API with your existing systems and UI, or choose to leverage our pre-built offerings

We’re integrated directly with multiple banks, providers and networks - meaning our payments are more reliable, and we can resolve and issues faster

“Partnering with Stitch enhances our ability to deliver seamless and reliable payment experiences, streamlines operations and improves payment success rates whilst offering our customers more ways to pay wherever they shop.”

“This has been the perfect partnership. Stitch has a clear value proposition that includes white labelling, secured tokenisation, the best support model and a true understanding that this is a mutual-beneficial partnership.”

“I had a great sense of comfort when working with the Stitch team knowing they fully support our vision and our obsession with checkout experiences in our different channels.”

“As a payment provider that shares our vision for innovation and efficiency, together we’ve simplified transactions, enhanced customer experiences, and driven growth.”

ISO 27001 + PCI DSS Level 1 certified

Stitch meets the highest possible global standards of data security and protection.

Our policies move through constant iteration and undergo rigorous testing in order to ensure that we proactively mitigate any potential threats to Stitch’s payment- and client data.

Streamline payments and boost your revenue.

Improve conversion, reduce costs and minimise admin with Stitch.