Improve collections on recurring payments

Reduce failed and missed collections, improve authentication rates for DebiCheck mandates and grow recurring revenue with multiple payment method fallbacks.

Improve authentication + collection rates

For businesses offering collections via authorised DebiCheck, Stitch can enable higher authentication rates with multiple routes for mandate auth - whether online or via TT3 realtime at POS. DebiCheck reduces fraud and incidence of disputes, leading to more successful collections

Offer fallback payment methods

Allow consumers to choose from several recurring payment methods - including fallbacks in the event of a failed or missed payment

Reconcile payments across methods

Easily reconcile transactions and get a holistic view of any missed or failed payments to better understand your collections performance through a single dashboard, with standardised reporting

High touch support for quality collections processes

We know collections use cases look different for every merchant. Stitch works closely with each client to ensure their collections processes are set up for success – from integration to continual monitoring and data quality assurance.

Customised integrations for collections use cases

Solve for your particular use case with optimised flows, through one integration – including once-off plus recurring transactions enabled through a single flow.

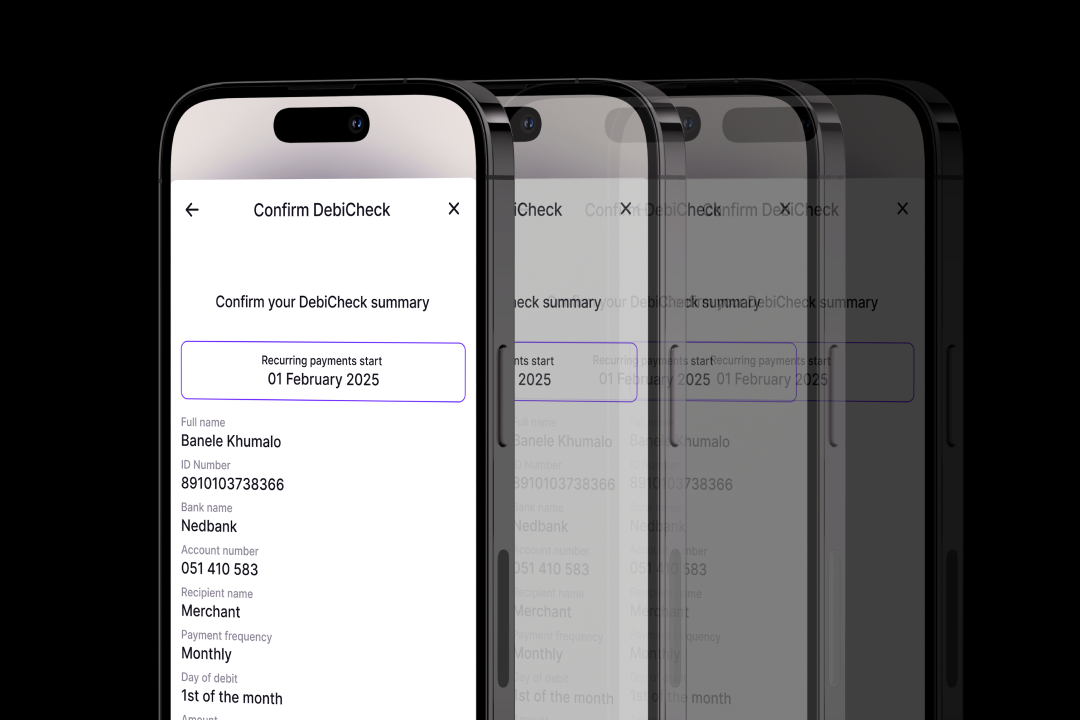

DebiCheck for recurring collections

While debit order and card remain popular collection methods and viable fallbacks, DebiCheck is recommended as a secure and reliable form of collections, to help merchants reduce fees and improve collection rates.

Reduce unexpected disputes

Eliminate loss in revenue and prevent debit fraud with digitally authorised DebiCheck mandates

Increase security for customers

Ensure security through a digitally tracked mandate, tracked through the customer’s bank

Priority processing

DebiCheck transactions are processed with priority during morning settlement periods, improving collection success rates

Never miss a collection

Connect with our team to see how Stitch can optimise your collections