Demand for smartphone or digital wallets rises in South Africa

Smartphone-based digital wallets, such as Samsung Pay, Apple Pay and Google Pay, represent one of the fastest-growing payment methods in South Africa and around the world. We’ve seen demand for this online payment method across industries - from e-commerce, to travel, to online gaming.

Smartphone-based digital wallets, such as Samsung Pay, Apple Pay and Google Pay, represent one of the fastest-growing payment methods in South Africa and around the world. We’ve seen demand for this online payment method across industries - from e-commerce, to travel, to online gaming.

Digital wallets enable customers to store tokenised versions of their credit and debit cards and access them securely for contactless in-person payments, and one-click online payments.

Customers love the security and convenience of digital wallets, but what are the benefits for merchants?

What are digital wallet payments?

If you’ve ever used your smartphone to make a contactless payment in store, or to complete a transaction quickly online via card details previously stored in an Apple, Samsung or Google Wallet, then you’ve made a smartphone or digital wallet payment.

Smartphone wallet payments, sometimes called e-wallet payments, are growing in popularity both in South Africa and around the world due to the high level of convenience and security they offer. In fact, data from Discovery Bank shows the volume of digital wallet transactions grew 91% from 2019 to 2023. Meanwhile, a 2022 survey from McKinsey showed the share of consumers globally that plan to use three or more digital wallets in coming years rose to 30% in 2022, from 18% a year earlier.

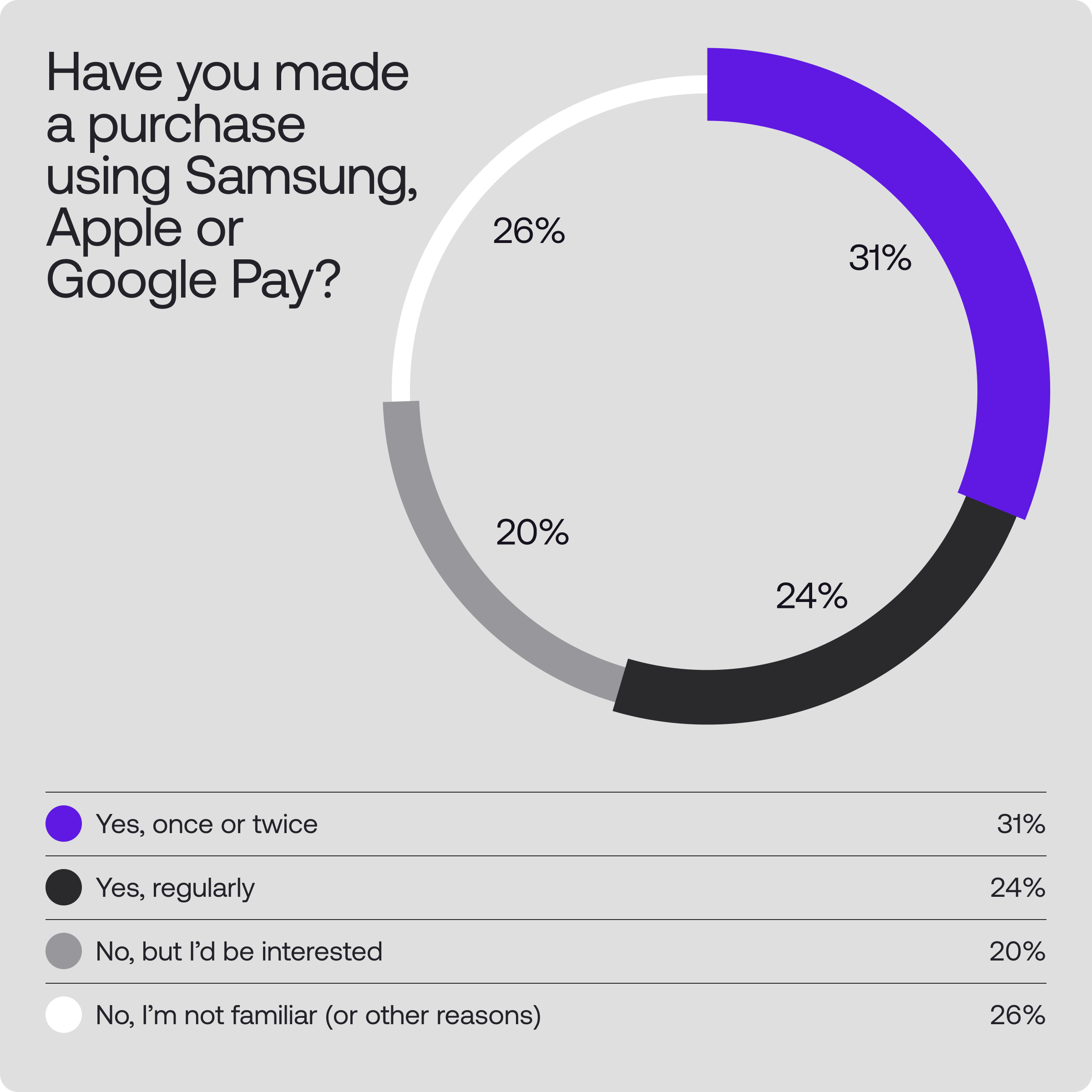

Our own research in South Africa shows a similar enthusiasm among consumers. Our recent survey on e-commerce consumer preferences found 52% of South African consumers have used a digital wallet to complete a tap-and-pay transaction or online payment in the past year, while 60% expect to use it in the coming year.

What are the benefits of accepting digital wallet payments?

There’s a number of reasons that smartphone wallets like Apple Pay, Google Pay and Samsung Wallet have taken off in South Africa. The first is simple convenience: these wallets offer the option to store multiple different credit or debit card and loyalty card details safely. They also offer a faster and more seamless way to make card payments.

Additionally, digital wallet payments come with strong security features. Their identity verification enables safer transactions, which is a key concern for South African consumers.

Specifically in the e-commerce space, there are a number of advancements in progress that will make the digital wallet payments experience even more seamless for consumers. One example is the introduction of “instant checkout” or “Instant buy” options on Apple Pay. These will enable customers to complete an Apple Pay transaction with a single tap, and without the need to sign in. The digital wallet will immediately fill all details, from the payment information to the recipient’s delivery address.

This sort of technology represents a major step forward in reducing customer friction. While major e-commerce companies such as Amazon already offer a version of instant checkout, this is based on the customer already being known to the merchant, with their details stored securely on the merchant side. The tokenized data storage and security functionality of smartphone based digital wallets could enable merchants to offer instant checkout even for customers who are visiting a merchant’s website for the first time.

How it works

Digital wallet solutions allow users to store their card details securely via an application on their phone.

The wallet provider – such as Apple, Google or Samsung – provides a product interface layer. They store the user’s card details securely - often using encryption or tokenisation - and, at the point of capturing that card information for the first time, authenticates it with their bank.

When the user goes to make a transaction using a digital wallet, for instance at an e-commerce checkout, their card details are fetched from that third party provider.

As part of this payment process, the user typically verifies their identity again, often via biometrics or password. Because of this, the card details are marked as already authenticated by the third party provider, removing the need for further security checks or 3DS. This creates a seamless payment flow.

On the merchant side, when a payment is initiated, the merchant must call, authenticate and retrieve the encrypted card details, then group them with other transaction data such as the transaction amount and additional metadata that signals the payment was from a digital wallet. This collected information is then placed on card processing rails to be processed in the same way as other card transactions.

The above process requires the merchant to manage the relationship with the wallet provider and, separately, a payment provider. Stitch works to streamline this process so the merchant doesn’t need to manage multiple relationships. With one integration, we can enable access to all three major wallets and manage the entire end-to-end process - or just a part of it, if preferred.

With Stitch, the payment process works consistently across native mobile applications, the web, or wherever the client is coming from, and we can provide a consistent experience via one integration. We work closely with merchants to build payments into their infrastructure perfectly; we don’t have a one-size-fits-all approach.

How easy is it to start accepting smartphone wallet payments?

Stitch offers merchants the ability to easily integrate all three digital wallet providers - Apply Pay, Google Pay and Samsung Wallet - in one integration, with the help of a collective software development kit (SDK). This cuts down development and design steps in the integration process. Our SDK includes pre-built tools that make it easy to check what methods are possible on a given customer’s device and to pull the relevant payment methods into your website or app’s checkout function.

On the back end, Stitch can handle the payment certificates, decryption and wallet configuration. We work directly with enterprises to make sure the methods they want to offer are integrated into their checkout flow.

At Stitch, we continually update our solutions to meet the latest requirements and offer the latest payment methods. Enterprises can manage their integrations through a single point of entry, and we add new methods as they are released.

Stitch is also PCI DSS Level 1 compliant and ISO 27001 Certified, so customers and merchants know their payments are safe.

Integrate Stitch smartphone wallets into your payments stack